News

Industrial

In the field of image sensors, Samsung and Sony are fighting

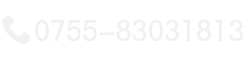

South Korea's Samsung Electronics will launch a slap in the face of the supply of image sensors for smartphone camera functions. Xiaomi, the world's fourth-ranked person, announced on August 7 that it will use Samsung's new image sensor launched in May. The 5th OPPO will also be announced in the near future for brands targeting young people in emerging market countries. Samsung's strategy is to catch up with Sony, the world's number one in the field of image sensors, by supplying Chinese companies.

Xiaomi uses Samsung's 64-megapixel image sensor

On August 7, Li Jishuo, the executive of Samsung's System LSI Division, stressed at a hotel in Beijing that the world's first smartphone with a 64-megapixel image sensor will be available in the near future. Hope to continue to create new products and technologies with Xiaomi. Then Lin Min, president of Xiaomi, nodded with a satisfied expression.

Xiaomi will be equipped with a new CMOS (Complementary Metal Oxide Semiconductor) image sensor "GW1" released by Samsung in the new smartphone for the brand "Red Rice" for young people. It features 64 million ultra-high pixels with high-end models that are comparable to SLR cameras and no-reflex cameras.

Xiaomi said that the resolution will increase by 34% compared to the current highest smartphone of 48 million pixels. At the press conference, Xiaomi showed the enlarged image after shooting, and the text on the road sign in the picture can be clearly seen. In this way to promote its superb performance.

Why did Xiaomi use Samsung's high-performance sensor? Many young people in the world love to take photos and comment on social networks (SNS) such as Instagram and WeChat. Photo performance has become a decisive factor in choosing a smartphone. In May 2018, Xiaomi set up a research and development department focusing on camera functions. In addition to China, it also has developers in Japan, the United States, Europe and India, and has been vigorously promoting research and development. In China's smart phone market, Huawei Technologies has a share of more than 30%, ranking first in terms of obvious advantages, and Apple in the United States ranks fifth in less than 10%. For the reason, analysts familiar with Chinese IT products explained that "the reason is that Huawei's mobile phone can make a beautiful 'self-portrait' impression deeply rooted in people's hearts."

On the other hand, Samsung chose Xiaomi as the target of supply, considering that the company is growing in China and emerging market countries. In China, Xiaomi has the fourth largest share of more than 10%, and ranks first in India. In Russia, it is also expanding its share. In China, Samsung’s share of smartphones is low, and there is a view that Samsung has changed its policy of expanding its business by supplying image sensors to smartphone manufacturers in China.

Samsung's partners are not limited to Xiaomi. According to Chinese media reports, OPPO's young brand-oriented brand "Realme", which is expanding in emerging market countries, recently announced a new model using Samsung's new image sensor. Realme is expanding its share in India and Southeast Asia. The strategy adopted by Samsung is believed to be to expand the position of Chinese smartphone manufacturers by dissolving the supply of Chinese image sensors.

"We strive to reach the world's No. 1 position in the semiconductor field outside of memory by 2030, and image sensors may jump to the top earlier." South Korean media reported that Samsung executives had held a press conference in Seoul in May. This is a rhetoric. It is said that the trump card in Samsung is the new image sensor GW1.

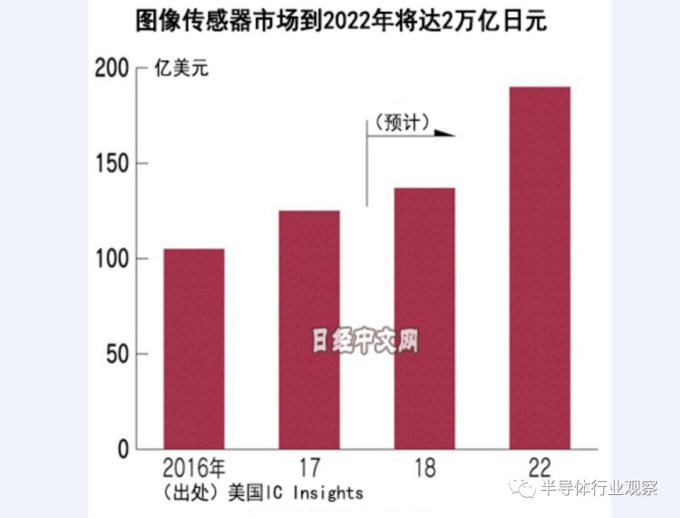

On the one hand, how will Sony respond to Samsung's offensive? Sony relies on the color technology accumulated by camera CCD (Charge Coupled Device) to force other companies, and is adopted by many smartphone manufacturers on medium and high-end models. In order to achieve further growth, it is planned to invest 600 billion yen in equipment in the three years to 2020.

Omori Tie, a senior analyst at the research firm Japan Techno Systems Research (Chiyoda-ku, Tokyo), pointed out that "Samsung hopes to take advantage of the supply of high-end products to China and seize market share from Sony."

At the end of the Xiaomi conference, Lin Bin, the founder of Xiaomi, the founder and CEO of Xiaobo, known as China's Jobs, said that there is still news. Subsequently, he revealed that he will launch a smartphone equipped with a 100-megapixel image sensor being developed by Samsung. Can the "alliance" formed by Samsung and Chinese companies proceed smoothly? The sales of red rice's new smartphones may first become a touchstone.

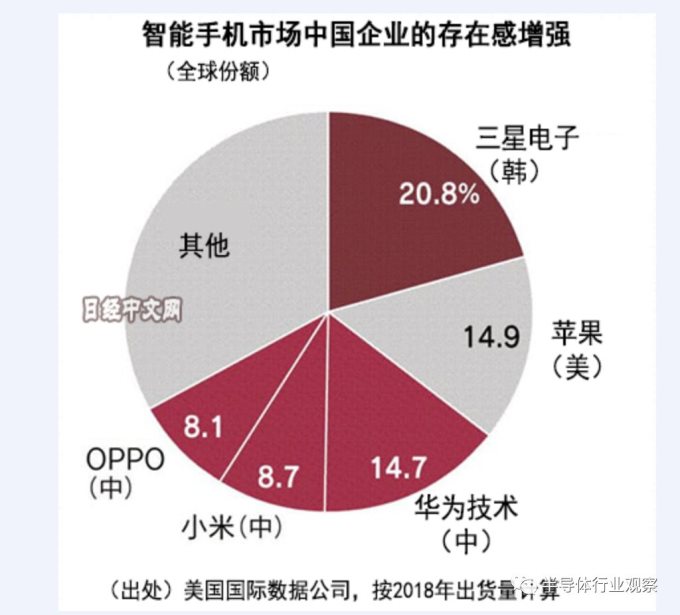

CMOS sensor market increased to 1.5 times by 2022

According to statistics from the US IC Insights survey company, the market for CMOS image sensors has grown at an average annual rate of more than 10% in the last six years. It will continue to expand in the future. The market size of only US$12.5 billion in 2017 is expected to reach US$19 billion in 2022, increasing to 1.5 times.

The growth engine is exactly the CMOS sensor for smartphones. At present, there is a sign of a peak in the growth of smartphone shipments. On the other hand, with the multi-camera trend of multiple cameras equipped with multiple cameras, the demand for CMOS sensors will continue to increase.

Observing the world market, the situation of South Korea's Samsung Electronics challenged Sony with more than half of the share, but the stage of competition is not limited to smartphones.

With the popularity of the Internet of Things (IoT), the demand for sensors such as surveillance cameras is also increasing. By the 2020s, it is expected to become popular in the automotive field where autopilot is indispensable. The extent to which the demand for "electronic eyes" as an artificial intelligence (AI) era will be grasped will lead to the dominance of related fields in the future.

Pre:Hydration sensor benefits dialysis patients 2025-12-30

Next:Structural design of near-infrared absorption photoelectric sensor 2025-12-30

Collect

Collect

Navigate:

Navigate: